Investor ownership in 5 Canadian provinces

February 22, 2023

Stats Canada and Canadian Housing Statistics Program have released data on investor ownership in Canada in 2020. The report looked at home ownership in Ontario, Nova Scotia, British Columbia, Manitoba and New Brunswick.

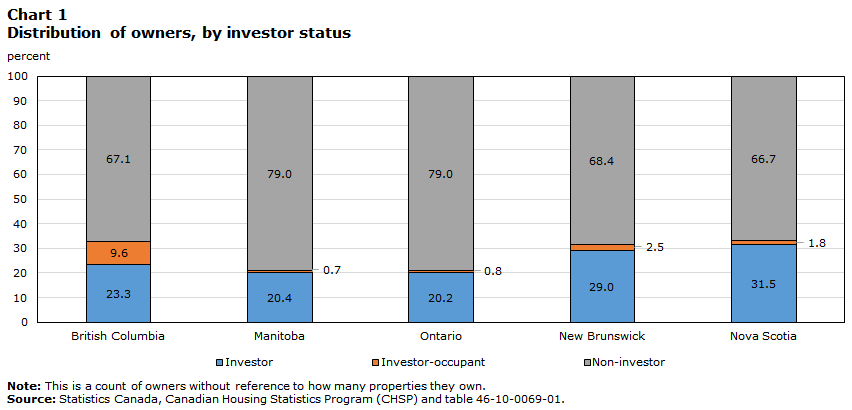

Of those, it found Ontario had the lowest proportion of investors at 20.2% and Nova Scotia had 31.5%. The report looks at ownership of properties and classifies the owners within a group.

An investor is stated as follows:

“An investor is defined as an owner who owns at least one residential property that is not used as their primary place of residence. Individual owners who own a single property in the same province as where they reside are not considered investors, so long as it is not a property with multiple units.”

The report does a good job in separating out investor-occupants since this is a very common occurrence when home owners rent out their basement units to assist in mortgage payments.

”An owner is classified as an investor-occupant if they own a single property with multiple residential units, one of which is their primary place of residence. For example, this category includes owners of a house with a laneway unit or basement suite and owners of a duplex who live in one of the units. In all cases, at least one of the units must be occupied by one of the owners.”

Interesting Findings

- Overall among houses and condominium apartments, one in five are used as investments in the 5 provinces combined.

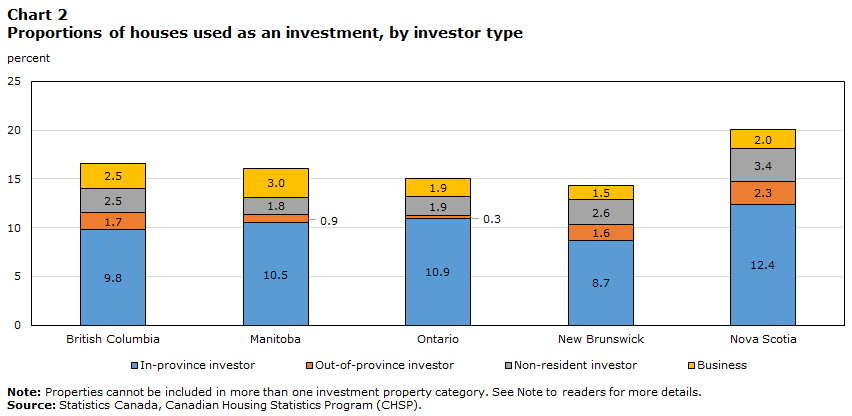

- Condominium apartments are used as investments most often. Ontario’s investor ownership of condominiums sat at 41.9% in 2020.

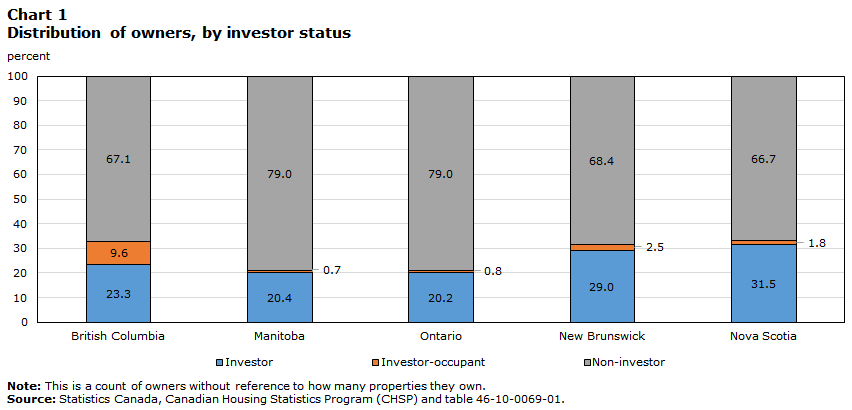

- Investment properties are usually owned by owners who live in the same province.

- Nova Scotia, more than 1 in 20 houses is used as an investment by a person living outside the province or the country.

- Proportion of investment properties are higher in the core areas of CMAs

The chart below looks at the overall distribution of properties owned by investors.

This chart shows the proportion of houses used as investments.

This chart shows the proportion of condominiums and apartment used as investments.

The Short Comings and Caveats of This Report

The report doesn’t separate corporations and governments from the mom and pop landlords. That information is vital to truly understanding the trend of large investment fund ownership, a trend we have been seeing take place for many years south of the border.

This was a much anticipated and needed report from Stats Can, hopefully we can get more of these down the line with finer data points.

You can view the full report here.